Ways to Support Ministry: Publicly Traded Securities

Making a gift of stocks or mutual funds (publicly traded securities) is simple.

This is a Tax-Efficient way to give now to support ministry at your local church, camp or any other Free Methodist Church in Canada ministry. Since gifts of stocks or mutual funds come from assets rather than income, they receive a more favourable tax treatment.

Gifts of stocks or mutual funds are a simple and efficient way to make a substantial gift to the church for its use now, while at the same time decreasing your out-of-pocket expense.

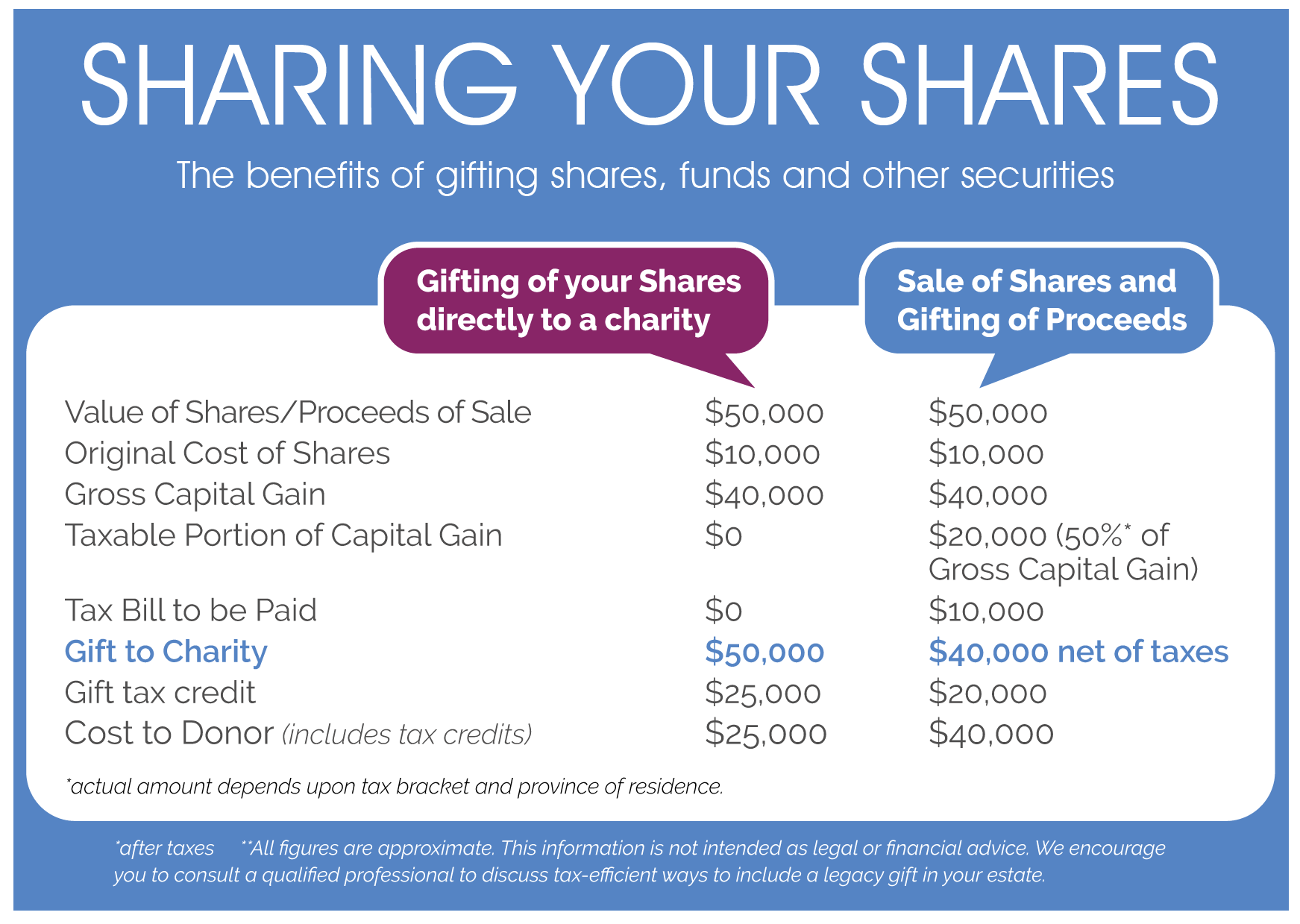

If you sell stocks or mutual funds privately, you are taxed on 50% of the capital gains. However, if you gift stock or mutual funds directly to charity, you pay no tax on the capital gains while also receiving a donation tax receipt for the full market value of the stock or mutual fund. This means that the gifting of securities which have appreciated in value is a much more tax-efficient way to give to the church than selling the securities yourself and then donating the cash.

The Free Methodist Church in Canada can handle most transactions on behalf of your church/camp or FMCIC ministry at no cost/fee.

If you are making a gift of stock or mutual funds to one of our local churches, your local church will issue a charitable receipt. If you are making a gift to one of the ministries of The Free Methodist Church in Canada, the FMCIC will issue you a receipt.

You may also wish to consider donating stocks or mutual funds in your will. Contact our Planned Giving partner, Advisors with Purpose to discuss this option – This is a free, confidential service with no obligation and they will not sell you anything. You can schedule an appointment with them at fmcicdev.wpengine.com/awp

For more information, or to make a gift of stocks or mutual funds to your church, FMC Camp or FM Ministry, please contact The Free Methodist Church in Canada, Director of Administration at: info@fmcic.ca

The information on this page does not constitute legal or professional advice and should not be substituted for appropriate professional advice. The Free Methodist Church in Canada strongly recommends that you seek professional legal and financial advice to ensure your financial situation and those of your dependents are considered; that your tax situation is reviewed; and that your legacy gift is tailored to your circumstances.