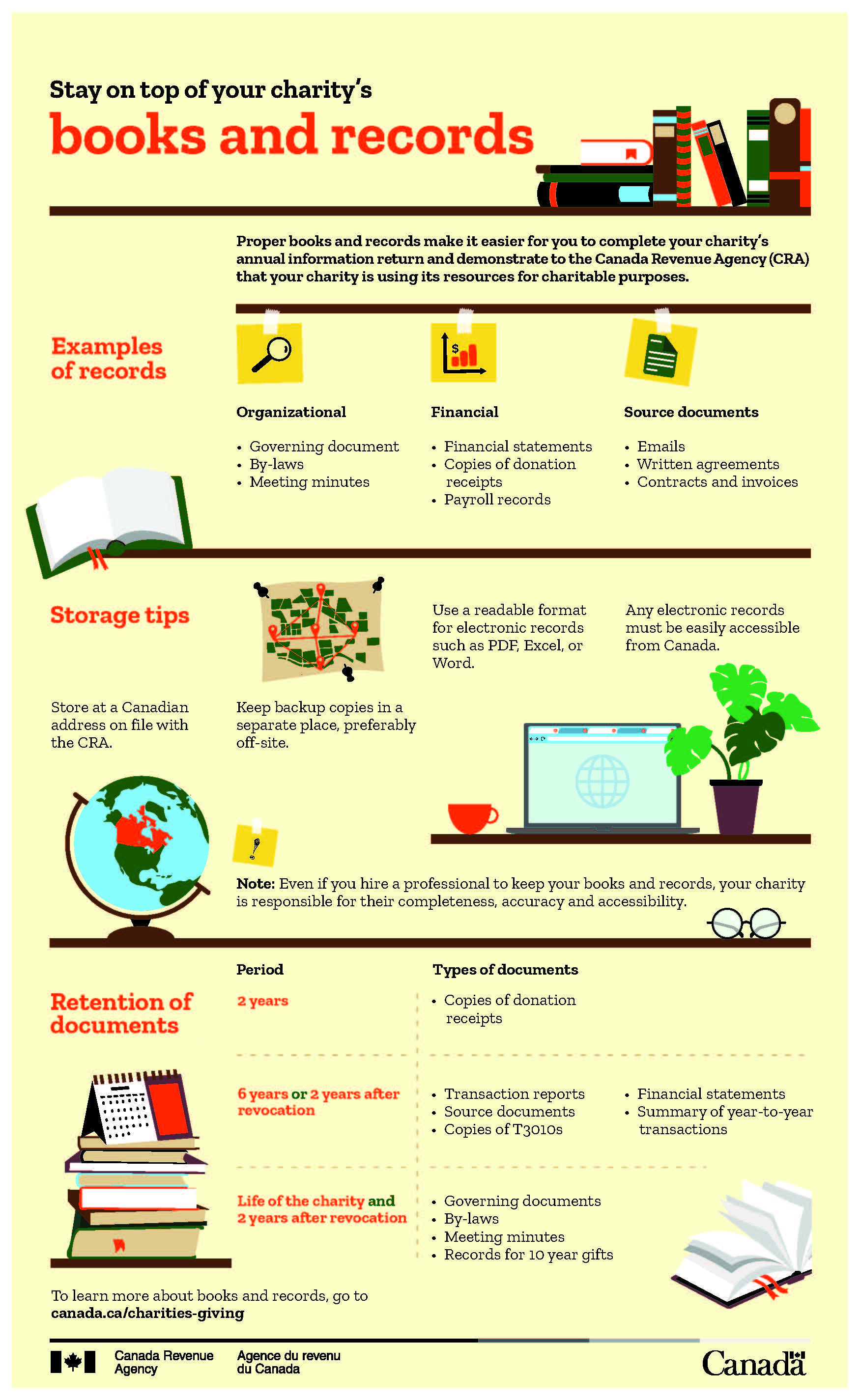

A registered charity must keep adequate books and records. A charity’s books and records must allow the Canada Revenue Agency (CRA) to:

- verify revenues, including all charitable donations received;

- verify that resources are spent on charitable programs; and

- verify that the charity’s purposes and activities continue to be charitable.

For more information, watch CRA’s recorded webinar Financial statements and books and records.

Books and records include:

Governing documents (incorporating documents, constitution, trust document), bylaws, financial statements, copies of official donation receipts, copies of annual information returns (Form T3010, Registered Charity Information Return), written agreements, contracts, board and staff meeting minutes, annual reports, ledgers, bank statements, expense accounts, inventories, investment agreements, accountant’s working papers, payroll records, promotional materials, and fundraising materials.

Books and records also include source documents. Source documents support the information in the books and records, and include items such as: invoices, vouchers, formal contracts, work orders, delivery slips, purchase orders, and bank deposit slips.