¶878 MINISTERS’ AND EMPLOYEES COMPENSATION AND BENEFITS GUIDELINES

The Free Methodist Church in Canada

This booklet provides guidelines relating to salaries and benefits for ministers and employees of Free Methodist churches in Canada. They are reviewed by the FMCIC Board of Administration on an on-going basis and this booklet is updated periodically.

The guidelines are for use by churches, ministers, and other appointed staff, to encourage equitable, consistent remuneration practices and personnel policies. Following these guidelines will create an environment conducive to strong ministerial leadership.

The guidelines in this booklet apply to full-time appointed ministers and associates/assistants. Other employees, employed at least 20 hours per week, may participate in the LTD insurance, health care insurance and group life insurance package.

This booklet is a description only of the main features of various Plans. It does not create or confirm any contractual rights. It should be understood that all rights and interpretations will be governed by the various Plans referred to in the booklet, “Government legislation, Church Policy and Administrative procedures.”

MINISTERS’ AND EMPLOYEES COMPENSATION

AND BENEFITS GUIDELINES

1. EMPLOYMENT COMPENSATION

1.1 Employment Compensation – Ministers

1.2 Multiple-Ministerial Staffing

1.3 Housing Allowance

2. RETIREMENT INCOME PROGRAM

2.1 FMCIC Pension Plan

2.2 Canada Pension Plan

2.3 Old Age Security

2.4 Retirement

3. INCOME PROTECTION PROGRAM

3.1 Short Term Disability/Sick Leave

3.2 Long Term Disability (LTD) Insurance

3.3 Employment Insurance (EI)

4. HEALTH CARE PROGRAM

4.1 Dental Insurance

4.2 Major Medical Insurance

4.3 Vision Care

5. SURVIVOR PROTECTION PROGRAM

5.1 Life Insurance

5.2 Optional Life Insurance

6. OTHER BENEFITS

6.1 Vacation – Ministers

6.2 Statutory Holidays

6.3 Special Leaves

Compassionate Leave

Maternity/Parental/Compassionate Family Care Leave

Special Ministries Leave

Continuing Education Leave

Leave of Absence

Sabbatical Guidelines

6.4 Pastoral Care

7. OTHER POLICIES AND GUIDELINES

7.1 Travel Expense

7.2 Transition/Transfer/Retirement

7.3 Ministerial Moves

7.4 Centralized Payroll Plan

7.5 Malpractice Insurance

1. EMPLOYMENT COMPENSATION

Ministers have responsibility to provide for themselves and their families, and are expected to maintain a lifestyle similar to that of the congregation. However, they may be hesitant to bargain for financial compensation, as this may appear materialistic.

To determine compensation for your minister, investigate what salaries are provided by congregations of similar size, particularly in your area. It may also be helpful to investigate salaries for teachers and principals in your community. Another useful comparison is the average salary of the group your church is targeted to reach. For each comparison, it is important to note any special income tax provisions available to ministers. For most Free Methodist churches, the above information will assist in establishing fair ministerial compensation.

1.1 EMPLOYMENT COMPENSATION – MINISTERS

Total payments fall into a number of categories that recognize the professional necessities of the work.

These might include:

— basic salary

— housing (supplied housing or a “Housing Allowance”)

— benefits (Employee and Employer shares)

— travel expenses, including entertainment

— books and professional supplies

— other benefits and allowances.

A finance committee, looking at the list, may think “These are all costs to have a minister on site.” A minister may think, “The first two or three items are part of my salary; the others are expenses connected with my work, and not part of salary.”

To bring consistency to Free Methodist churches in Canada and to ensure conformance to tax laws, the following guidelines should be used:

Ministerial compensation includes only basic salary and housing (or housing allowance).

Travel and entertainment expenses, the employer’s share of benefits, books and supplies, and other allowances are part of the church’s expenses and, although they may be treated in the society’s annual budget as part of the overall cost for having a minister, they are not considered as ministerial compensation for purposes of this booklet.

1.2 MULTIPLE-MINISTERIAL STAFFING

Multiple staff appointments are detailed in Paragraph 851 of The Manual.

1.3 HOUSING ALLOWANCE

The Income Tax Act stipulates that the annual rental value of housing provided by an employer without cost must be included in the employee’s income for tax purposes. Eligible individuals may claim a “clergy” housing allowance deduction on their personal tax returns. To support such a deduction, the employee must obtain a signed certificate from his/her employer confirming eligibility provisions were met in the year.

The certificate forms part of the tax return.

To qualify for the clergy housing deduction, a person must satisfy both a status test and a function test. In The Free Methodist Church in Canada, a person must have been granted a Lay Minister’s License by the local church policy/official board and must have signed a Ministerial Candidate’s Statement of Affirmation (¶871) to satisfy the status test. To meet the function test, an individual must be in charge of or be ministering to a congregation or be engaged in full-time administrative service by appointment of The Free Methodist Church in Canada.

Persons who qualify and do not live in a Manse are entitled to claim the lesser of:

a. The greater of $1000/month times the number of months the person qualifies for the housing allowance (maximum allowance $10,000) or one third of gross remuneration for the year

OR

b. the fair rental value of the residence plus the cost of utilities. Utilities do not include property taxes.

Persons who live in a Manse are asked to contact The Free Methodist Church in Canada for more specific assistance in regards to the housing allowance.

BENEFITS PROGRAM

The FMCiC Benefits Program is an important part of the total compensation employees receive. Together with various government plans these benefits help protect them and their eligible dependents against loss of income and unexpected financial burdens resulting from illness, disability or death, as well as providing a continuing income after retirement.

The benefits program is available to both ministers and church employees provided paid employment is a minimum of twenty hours per week.

A Word about Costs

The cost of the benefit program is shared by the employer and the employee. Long-term disability (LTD) premiums are paid fully by employees so that disability income will be tax-exempt.

2. RETIREMENT INCOME PROGRAM

The FMCIC Pension Plan is designed to integrate with benefits payable under the Canada/Quebec Pension Plan to provide employees with continuing monthly income in their retirement years. The four plans from which employees may receive regular income when they retire are:

- FMCIC Pension Plan

- Canada/Quebec Pension Plan

- Old Age Security

- Registered Retirement Savings Plan

2.1 FMCIC PENSION PLAN

Participation in the FMCIC Pension Plan is mandatory upon employment as an appointed minister.

Until March 31, 2009 two defined benefit options were available: Plan A, where the employee contributed 5.0% of basic salary, housing allowance, utilities. The employer (local church) paid 5.3% of the same total. Plan B, where the employee did not contribute anything and the employer paid 5.2% of basic salary, housing allowance and utilities.

The plan is registered with Canada Revenue Agency (037083). Annual information statements are sent to participants.

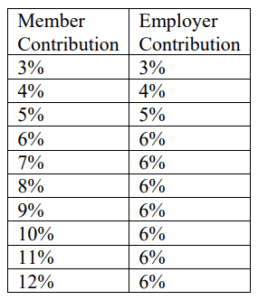

On April 1, 2009, Plans A and B were frozen and a defined contribution (DC) component was introduced to the Plan. Key highlights of this defined contribution component are:

Details of the FMCIC pension plan, and benefits paid to participants, are contained in a booklet entitled “The Ministers’ Pension Plan of the Free Methodist Church in Canada” which is available from the Ministry Centre or may be downloaded from the FMCIC website at https://fmcic.ca/en/admin-index/ministers-pension.

2.2 CANADA PENSION PLAN

The federal government administers this mandatory plan. The employee and the employer (local church) make matching contributions. These are payroll deductions at source and the funds are sent to Canada Revenue Agency. The deduction is based on basic salary, utilities, RRSP and the taxable portion of Group Life Insurance premiums. Housing allowance is excluded from this calculation. Information about the Canada Pension Plan maximum monthly benefit is available at www.sdc.gc.ca.

Employee contributions are exempt from income tax.

2.3 OLD AGE SECURITY

The Old Age Security is payable in addition to the Canada/Quebec Pension Plan benefit. It is paid at age 65 assuming that residence requirements are met. Information about the Old Age Security maximum monthly benefit is available from the Financial Benefits section of the Department of Human Resources and Social Development Canada (HRSDC) website. Call 1-800-277-9914 or 1-800-255-4786 and request an application kit. The relevant information may also be downloaded from their website at www.hrsdc.gc.ca.

2.4 RETIREMENT

Retirement will normally occur during the calendar year in which the minister attains age 65. Contact should be made with the Ministry Centre to arrange for proper forms to be completed for the Minister’s Pension Plan. Employees planning retirement should also contact the local office of Health and Welfare Canada at least 6 months prior to age 65 to complete forms for Old Age Security, Canada Pension, Seniors Drug Card, Employee Health Tax, Medical Card, and Employment Insurance.

3. INCOME PROTECTION PROGRAMS

The Income Protection Programs provides employees with a regular income while they are off work because of sickness or disability. In addition the Government of Canada administers an Employment Insurance program which may provide benefits for any periods of unemployment.

3.1 SHORT TERM DISABILITY/SICK LEAVE

Ministers are normally permitted paid sick leave of 1-1/2 days per month of continuous service in the Canadian Conference, to a maximum of 18 days per calendar year. This is not cumulative and, if not needed, is not carried forward to any succeeding year. If more than 18 days is needed in a year, a local church official board may act to extend the short term paid sick leave.

3.2 LONG-TERM DISABILITY (LTD) INSURANCE*

LTD insurance is to provide on-going income to employees who are unable to fulfill their responsibilities due to illness or injury. The LTD plan is administered by The Free Methodist Church in Canada. LTD benefits apply only after a waiting period of 119 days. Full details are available from the Ministry Centre or may be downloaded from the FMCIC website:

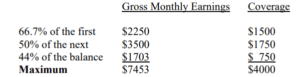

https://fmcic.ca/images/stories/administration/Accounting%20Forms/groupbenefits/SLFBookletCanadaEast.pdf Benefits are calculated on basic monthly salary, housing allowance, utilities (if paid by the local church). The benefit is calculated as follows:

Monthly premiums are paid in total by employees by payroll deduction. The plan is reviewed annually and information is provided when premium changes are made.

Under certain circumstances, there may also be eligibility to receive disability income payments from the Canada/Quebec Pension Plan.

3.3 EMPLOYMENT INSURANCE (EI)

Employment Insurance premiums are deducted by payroll deduction and remitted to Canada Revenue Agency. EI premiums are calculated on salary and housing allowance or, where housing is provided, the “fair rental value” of the supplied housing. The employer (local church) pays 1.4 times the amount contributed by the employee.

If information to apply for Employment Insurance is needed, go to the website:

www.servicecanada.gc.ca/eng/ei/application/employmentinsurance.shtml or call 1-800-206-7218.

4. HEALTH CARE PROGRAM

Health Care Insurance Benefits are provided to employees on a cost-shared basis.

4.1 DENTAL INSURANCE*

Employees and their families are covered by a Dental Benefits Plan administered by The Free Methodist Church in Canada through its insurance carrier, Sun Life Financial. Full details of the plan are outlined in the “Employee Group Benefits” booklet produced for The Free Methodist Church in Canada by Sun Life Financial.

Premiums are shared equally by the employee and the employer.

4.2 MAJOR MEDICAL INSURANCE*

Major Medical benefits provide supplementary health care benefits, which include semi-private/ward hospital accommodation, prescription drugs, and miscellaneous other health care benefits. Full details of the benefits are contained in a booklet produced by the company providing the coverage, Sunlife Financial.

The cost is shared equally by the employee and the employer.

4.3 VISION CARE*

A vision care benefit has been added to the current extended health care coverage. The coverage is for eyeglasses or contact lenses for every eligible person. The maximum benefit is $150.00 per eligible person in any period of 24 consecutive months.

The same deductibles and coinsurance apply to this benefit on a combined basis with the present extended health care.

5. SURVIVOR PROTECTION PROGRAM

5.1 LIFE INSURANCE*

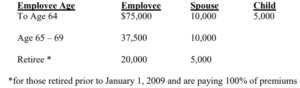

Employees and their families are covered by a group life insurance policy arranged by The Free Methodist Church in Canada. Full details are contained in the “Group Benefits” booklet produced for the FMCIC by the benefit provider.

Premiums are shared equally by the employee and the employer.

Life Insurance Coverages

5.2 OPTIONAL LIFE INSURANCE

All active members and spouses, under age 65, are eligible to apply for Optional Life Insurance Coverage.

The Optional Life Insurance is available in units of $10,000 up to a maximum benefit of $250,000. Applications are available from the Ministry Centre and completed applications are to be mailed to the Ministry Centre. The group policyholder’s name is “The Free Methodist Church in Canada.”

*The LTD Insurance, the Health Care Insurance and the Group Life Insurance are offered as a total package.

6. OTHER BENEFITS

Recognizing the need for refreshment and renewal, each church should have a written policy regarding vacation and days off for all employees. This should be in harmony with the labour laws of the province in which the church is located.

6.1 VACATION – MINISTERS

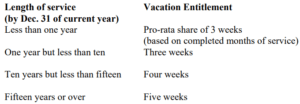

The following principles are given to local churches as guidance for setting up minimum paid vacation entitlements. An official board is, of course, free to grant more vacation time than is suggested below. Vacation entitlement is based on the principle of years of conference service under appointment (including time as a supply pastor), not service at a particular church. For example, a minister with 10 years of service in the Canadian Conference is entitled to paid vacation minimums based on that service, even in the first year of appointment to a local church.

A vacation week consists of seven consecutive days including one Sunday.

Vacation entitlement cannot be accumulated. It is to be taken in the calendar year except for special circumstances mutually agreeable to a minister and local church.

Attendance at general conference, family camp, and similar conference functions is part of the minister’s job-related responsibility and not part of vacation time.

All vacation should be scheduled in consultation with the pastor’s cabinet and official board. Vacation days taken must be recorded in suitable records.

Vacations (or the pro-rata share thereof) in a current year should be taken before transition to a new appointment.

6.2 STATUTORY HOLIDAYS

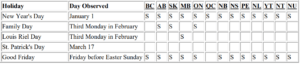

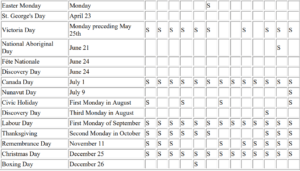

Statutory holidays are in addition to vacation time. Employees are entitled to statutory/provincial holidays annually as follows: The chart below, provided by the government of Canada, displays a list of national and provincial statutory (S) holidays observed in Canada. Holidays exist on the federal level and there are additional holidays for each province and territory. Each province has their own set of stat holidays which

are paid days off.

In cases where the above day(s) fall on Sunday, an alternative day may be taken.

Statutory holidays are non-cumulative.

Where provincial labour legislation permits additional statutory holidays not scheduled above, that legislation will apply.

6.3 SPECIAL LEAVES

Compassionate Leave

Employees may be granted leave of absence of up to three calendar days, with pay, in the case of bereavement of spouse, parents, brother, sister, children, grandparents, mother-in-law, father-in-law, sister-in-law, or brother-in-law. Further compassionate leave may be granted by the official board due to unusual circumstances (e.g. related special travel needs.)

Maternity, Parental, and Compassionate Family Care Leave

Maternity Leave, Parental Leave, and Compassionate Family Care Leave are granted according to labour law standards.

Special Ministries Leave

Ministers may be granted “special ministries” leave of absence for two weekends per year, exclusive of vacation, for special ministries as approved by the official board.

Continuing Education Leave

Continuing education for ministers is for the development, maintenance, updating, and upgrading of professional skills. These skills, developed in an individual involved in a continuing education program, will help bring the joy and satisfaction of a balanced and fulfilling ministry.

Continuing education refers to learning experiences chosen to enhance one’s ministry. These may be either for academic credit or non-credit. Ministers are required to develop a continuing education program in consultation with the ministerial education guidance and placement committee. Where possible, spouses should be included in learning experiences.

Local churches are encouraged to provide financial assistance to ministers for continuing education.

Leave of Absence

Guidelines for a Leave of Absence administered by the local church can be found in The Manual, Chapter 3 Handbook, Par. 374.6.

Sabbatical Guidelines

Guidelines for the development of a local church sabbatical policy are available through the credentialing coordinator or on the FMCIC website.

6.4 PASTORAL CARE

The Free Methodist Church in Canada recognizes the need to make provision for a confidential clergy care referral system and for counseling resources. The Free Methodist Church in Canada, has some funds, confidentially administered by a member of the MEGaP committee in consultation with the credentialing coordinator, which are available to ministers and their families to assist with counselling costs. Additionally, Focus on the Family maintains a confidential Clergy Care Hotline service intended to help ministers, their spouses, and their families. It is available free of charge to any minister. The hotline telephone number is 1- 888-5CLERGY (1-888-525-3749).

7. OTHER POLICIES AND GUIDELINES

The following list describes a number of matters relating to employment practices that are best understood through clearly-stated guidelines. Some are concerned with a minister’s relationship to the local church; others to his/her relationship to the conference.

7.1 TRAVEL EXPENSE

Reasonable reimbursement should be made to an employee for use of a personal vehicle for church-related business. This is unrelated to employment compensation.

To be reimbursed, the employee must submit an account (or log of travel) to the local treasurer. Dates of travel, number of kilometres travelled, and the purpose of the trips should be shown. Trips from home-to-office or any travel of a purely personal nature may not be claimed.

Guidance on current Canada Revenue Agency per kilometre rates are available from the Administrative Services Department at the Ministry Centre.

7.2 TRANSITION/TRANSFER/RETIREMENT

It is expected when a minister makes contact with another conference or outside agency regarding a job situation or placement, the director of leadership development and church health will be notified. It is also expected that a minister will give 60 days notice if transition is the intent.

7.3 MINISTERIAL MOVES

The costs of moving the pastor’s personal property shall be the responsibility of the receiving local church or new ministry/employer (if not the FMCIC). Where a minister living in a parsonage is leaving active ministry, (i.e. retirement or long term disability) and is not entering into another ministry or employment opportunity, and is in good standing, the conference will assist with moving expenses incurred up to a maximum of $1000. This policy also applies to the moving costs of a surviving spouse living in a parsonage should a minister die while under normal appointment.

All part-time ministers and part-time assistant ministers are responsible for their own moving expenses subject to any provision made with their receiving church.

Ministers moving to another conference, denomination, or other employment must make their own arrangement with regard to moving expenses.

7.4 CENTRALIZED PAYROLL PLAN

Participation in the Ministry Centre’s payroll service is mandatory for all local churches. It consists of automatic electronic funds transfers to employees’ personal bank accounts on a semi-monthly basis, corresponding withdrawals from the local church’s operating funds account, and includes preparation on behalf of the church of all payroll information slips and all Canada Revenue Agency forms required under Income Tax legislation. Details of the plan, and application forms are available from the Ministry Centre or may be downloaded from the FMCIC website.

7.5 MALPRACTICE INSURANCE

Each church should carry malpractice insurance on its paid and volunteer staff.