DEBT FREE + FINANCIALLY FIT SEMINAR

There is no question we live in a consumer culture where overwhelming debt is the accepted norm. The bondage of living under debt creates a stress that can threaten even the best of marriages and families. But you can have no debt and still be Financially ‘unfit’ which not only can be just as stressful, but prevent you from faithfully stewarding all that God has given you.

In the free live seminar and online course, we cover the basic financial methods and biblical principles needed to become financially fit. If you are interested in hosting a live 2-hour seminar, contact sandy.crozier@fmcic.ca. Bible Verses on Stewardship

You can also view the online video by going to courses.fmcicdev.wpengine.com, and select: “Debt Free and Financially Fit” (note you will be asked to create a login, but you can login as a guest)

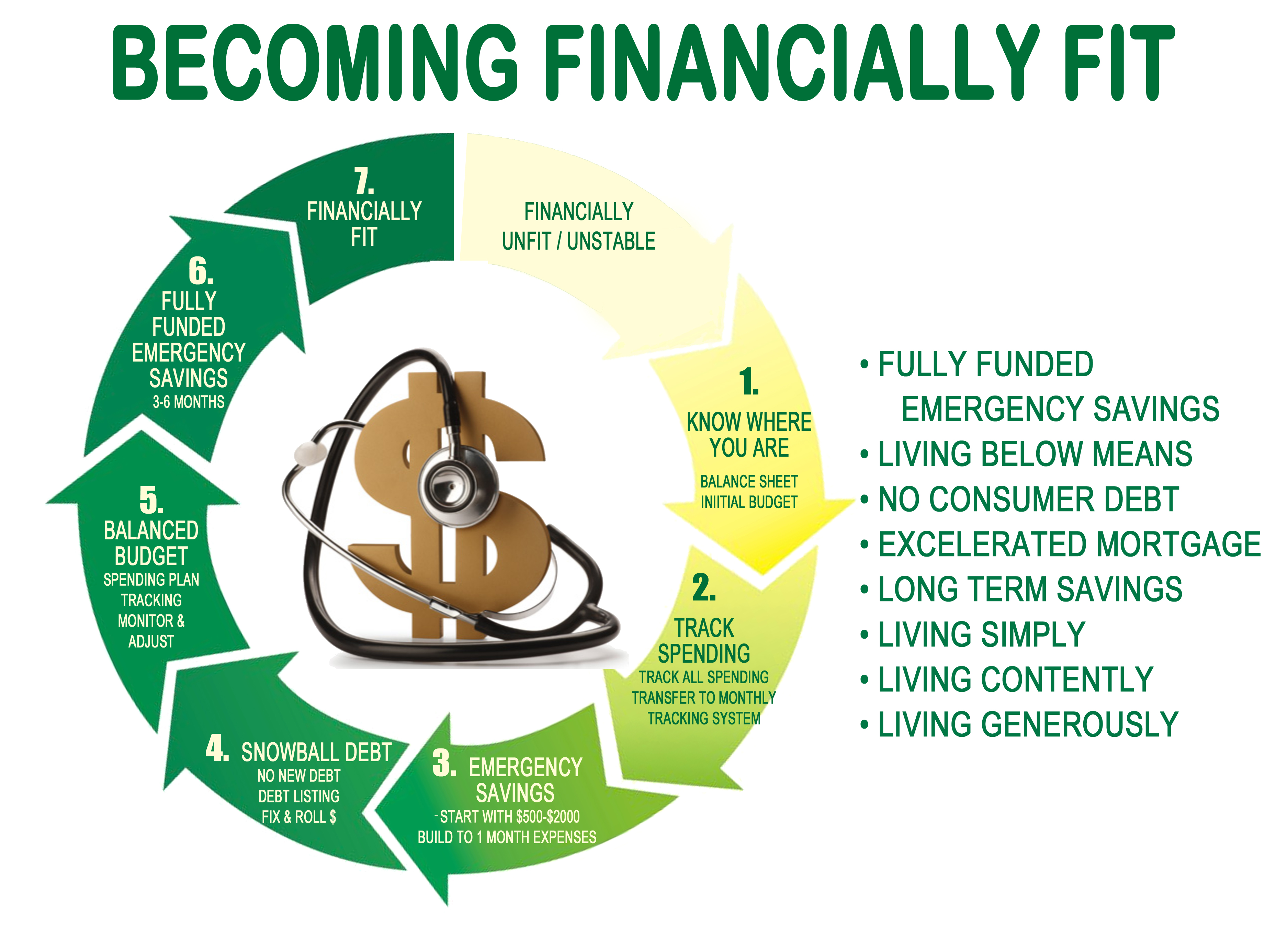

7 steps in living

Debt Free & Financially Fit

You need a plan if you want to become debt free and financially fit. Here are 7 steps that will walk you through getting out of debt and becoming financially fit.

Remember that it took time to get into debt… and it will take time to get out of debt. But freedom from debt and financial fitness are possible. But you must take the first step and start. Now.

1. Know where you are…

- Take stock of what you have and what you owe

- Using a Personal Net Equity or ‘Balance’ Sheet:

- List all assets

- List all liabilities

- Find your Net Equity

- Download: Net Equity / Balance Sheet FORM

- Create an Initial Budget by listing:

- All Income

- All Expenses

- Reality Check – You really need to know!

- Positive (you own more than you owe)

- Negative (you owe more than you own)

- Download: Budget PLAN – EXCEL

- Download: Budget Plan PRINT PDF

2. Know where it goes…

- where do you ‘bleed’ money?

- Track all miscellaneous Cash/Debit/Credit Spending

- Use a notebook to record

- Obtain receipts

- Add them all up and include in your initial budget

- Personal Spending Journal (2 sheets, double-sided and folding to create booklet)

Download: Personal Spending Journal

3. Start and Build your Initial Emergency Savings

- In order to break the cycle of turning to debt, you must start an emergency saving account

- While you have debt, build this up to one month’s expenses (this will take time)

- Keep in separate bank account – NO CO-MINGLING!

- Set something aside each pay (consider auto transfer)

4. Snowball your Debt

- BEFORE YOU START…

- PRAY– You need a change of heart and God’s help!

- NO NEW DEBT – You must commit to occurring NO NEW DEBT

- SAVE – You need an Emergency Savings Fund to stop the cycle of always turning to DEBT when ‘LIFE’ happens

- GIVE – Generosity breaks the hold that debt/money has on us & roots out selfishness

- SHARE – Tell a trusted person to keep you accountable & encourage you as you go

- CREATE YOUR DEBT LISTING

- List your creditors, your current balances, your minimum payments, and your current interest rates.

- Choose the best Debt Repayment Plan for you:

- Snowball Method – list your debts smallest balance to largest balance (provides tangible benefits/incentives as debts are paid off sooner)

- Avalanche Method – list your debts highest interest rate to lowest interest rate (saves some interest, but takes longer to see the first debt paid)

- Consolidation Method – consolidates all debt into one loan with lower interest rate (should be considered – but with EXTREME CAUTION because it does not change the heart/habit of what got people into debt and can dangerously use up equity in home)

- Snowball Method – list your debts smallest balance to largest balance (provides tangible benefits/incentives as debts are paid off sooner)

>> Download: debt-reduction-calculator blank

- SNOWBALL METHOD OF DEBT ELIMINATION

Stay with it until all debts are paid.

- Once Debt is all Paid…

- Accelerate Mortgage Repayment

- Save for Goals & Priorities

- Live Simply

- Live Generously

- Download: Snowball Quick Reference Guide

5. Balance the Budget…

- Adjust the initial plan as needed until you are balanced

- Convert as many payments to monthly as possible

- Goal is to ‘live below your means’

- Make Generosity a priority – give first not last

- Continually Monitor & Adjust as life happens

6. Fully Fund the Emergency Savings…

- Once your debt is paid using the Snowball Plan – use the money you were paying to debt and fully fund your savings to 3-6 months

- You are now ‘financially stable’

7. Living Financially Fit…

- Once your Emergency Fund is ‘fully funded’:

- Accelerated Mortgage

- Long Term Savings

- Education

- Special Projects/Giving

- Live Financially Fit:

- Spend less than you Make (live simply & contentedly)

- Avoid Debt (Keeps you free from bondage)

- Build Savings (Flexibility)

- Set Long-Term Goals (Helps you prioritize $$)

- Live Generously (Brings True Freedom & Life)